us germany tax treaty protocol

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. Amend the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with.

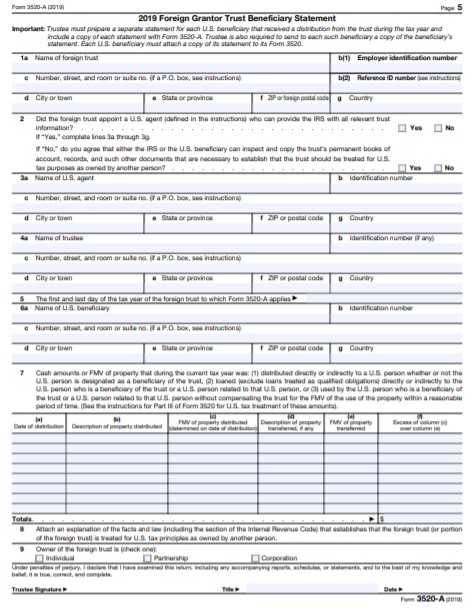

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on.

. June 30 2006 The Protocol Amending the United States-Germany Income Tax Treaty June 1 2006 amends the US-Germany income tax treaty the Treaty which took. B The decedents surviving spouse was at the time of the decedents death domiciled in either. The income tax treaty dated 1 July 2010 with the United Arab Emirates UAE ceased to apply 31 December 2021.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in. An Income Tax Treaty like the income tax treaty between Germany and the United States is designed to minimize inconsistent and double taxation although a tax treaty cannot. Protocol amending the convention between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal.

104 rows In the table below you can access the text of many US income tax treaties. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the. Republic of Germany or the United States of America.

Germany currently has income tax treaties with 96 countries.

Reflections On The Recently Signed Amendment Protocol To The Dutch German Tax Treaty Insights Dla Piper Global Law Firm

International Tax News And Other Global Updates For Q2 2022 Our Insights Plante Moran

Germany Norway Double Tax Treaty

Protocol To The Tax Treaty Between Germany And Ireland Has Entered Into Force Orbitax Tax News Alerts

Cyprus And Germany Sign Protocol To Amend Tax Treaty International Tax Review

Avoiding Double Taxation In The Uk And Germany Legamart Articles

2007 Ofii Tax Conferenceaventura Fl 1 U S Tax Developments Inbound Investment Into The U S Technical Updates Planning Strategies Presented By James Ppt Download

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

Should The United States Terminate Its Tax Treaty With Russia

Luxembourg Tax Treaty International Tax Treaties Compliance Freeman Law

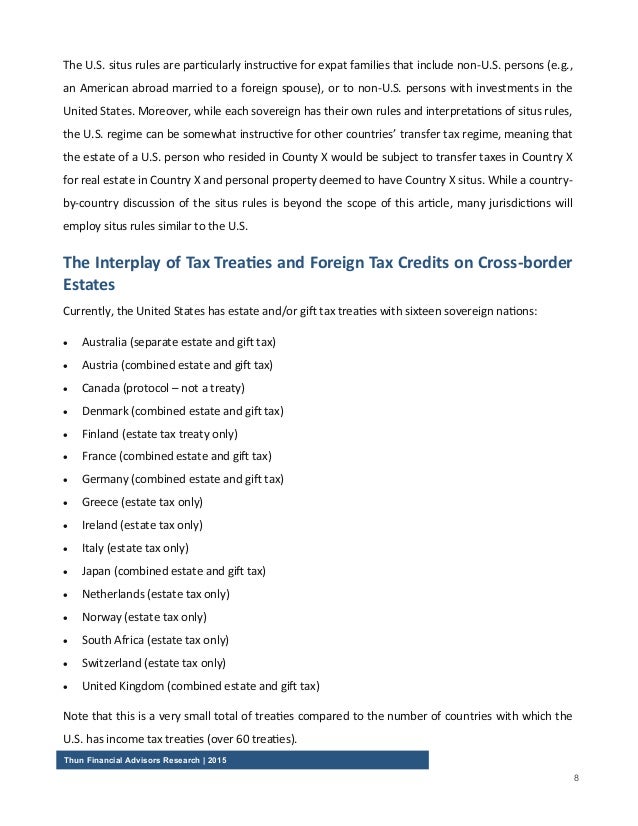

International Estate Planning For Cross Border Families

Germany Specific Tfx User Guide

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

Kyoto Protocol 10 Years Of The World S First Climate Change Treaty

Spanish Taxes For Us Expats Htj Tax

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

Double Taxation Taxes On Income And Capital Federal Foreign Office